Excitement About Guided Wealth Management

Excitement About Guided Wealth Management

Blog Article

See This Report about Guided Wealth Management

Table of ContentsWhat Does Guided Wealth Management Mean?7 Easy Facts About Guided Wealth Management ShownSome Known Incorrect Statements About Guided Wealth Management Our Guided Wealth Management IdeasThe Ultimate Guide To Guided Wealth ManagementGetting My Guided Wealth Management To Work

Picking a reliable economic advisor is utmost essential. Advisor duties can vary depending on a number of aspects, consisting of the type of financial consultant and the client's needs.A restricted consultant must proclaim the nature of the constraint. Supplying ideal plans by evaluating the history, financial data, and capabilities of the client.

Guiding clients to implement the monetary plans. Routine tracking of the monetary profile.

If any problems are come across by the monitoring experts, they iron out the origin and fix them. Construct an economic threat assessment and evaluate the potential effect of the danger. After the conclusion of the threat evaluation design, the advisor will certainly analyze the outcomes and supply a proper option that to be carried out.

What Does Guided Wealth Management Do?

In a lot of nations advisors are used to save time and minimize stress and anxiety. They will certainly aid in the achievement of the economic and workers objectives. They take the responsibility for the provided choice. Therefore, customers need not be worried about the choice. It is a long-lasting process. They need to research and evaluate even more areas to align the appropriate path.

This led to a rise in the net returns, expense financial savings, and also assisted the course to profitability. Numerous measures can be compared to recognize a qualified and experienced expert. Usually, advisors need to satisfy basic scholastic credentials, experiences and accreditation recommended by the government. The fundamental academic credentials of the advisor is a bachelor's degree.

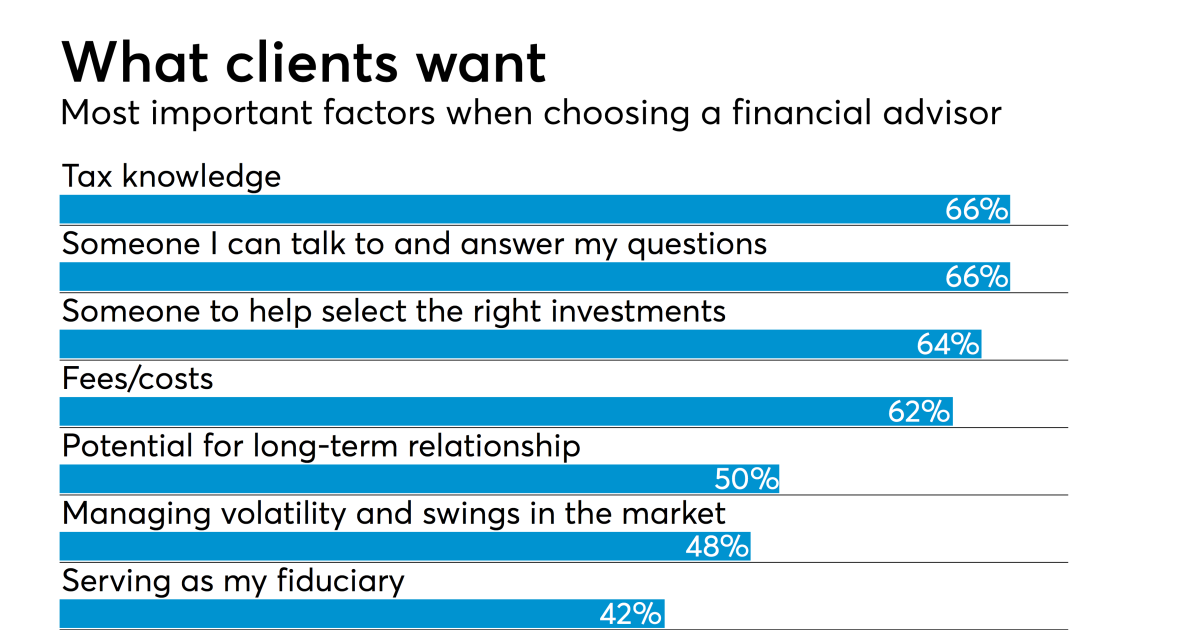

While seeking a consultant, please think about credentials, experience, skills, fiduciary, and repayments. Look for clearness up until you obtain a clear idea and full satisfaction. Always make sure that the advice you receive from an advisor is constantly in your benefit. Eventually, monetary consultants optimize the success of a business and likewise make it grow and flourish.

Not known Details About Guided Wealth Management

Whether you need somebody to aid you with your taxes or supplies, or retirement and estate preparation, or every one of the above, you'll find your solution below. Maintain reading to discover what the distinction is in between a monetary expert vs planner. Primarily, any type of specialist that can assist you handle your money in some style can be thought about a monetary advisor.

If your objective is to create a program to satisfy lasting economic objectives, then you most likely wish to enlist the services of a licensed economic planner. You can search for an organizer that has a speciality in taxes, financial investments, and retirement or estate planning. You might additionally ask concerning classifications that the planner brings such as Qualified Financial Organizer or CFP.

A financial consultant is just a broad term to explain an expert that can assist you handle your money. They might broker the sale and acquisition of your supplies, manage investments, and help you create an extensive tax obligation or estate strategy. It is important to note that an economic expert needs to hold an AFS certificate in order to offer the public.

A Biased View of Guided Wealth Management

If your monetary expert lists their solutions as fee-only, you ought to anticipate a listing Find Out More of solutions that they offer with a breakdown of those charges. These specialists do not provide any kind of sales-pitch and usually, the services are reduced and completely dry and to the factor. Fee-based advisors bill an ahead of time fee and afterwards earn compensation on the economic products you purchase from them.

Do a little research study initially to be certain the financial consultant you work with will certainly have the ability to take care of you in the lasting. The very best area to begin is to request for referrals from family members, good friends, associates, and neighbours that are in a comparable monetary situation as you. Do they have a relied on economic advisor and how do they like them? Requesting references is a great way to be familiar with a financial advisor prior to you also fulfill them so you can have a far better concept of just how to handle them up front.

Guided Wealth Management for Beginners

Make your possible advisor respond to these questions to your fulfillment prior to moving onward. You may be looking for a specialty expert such as someone that focuses on divorce or insurance policy planning.

A financial consultant will help you with establishing possible and sensible objectives for your future. This could be either starting a business, a family, preparing for retirement every one of which are important chapters in life that need mindful factor to consider. A financial consultant will certainly take their time to review your situation, short and long-term objectives and make recommendations that are best for you and/or your family members.

A study from Dalbar (2019 ) has highlighted that over twenty years, while the typical financial investment return has been around 9%, the average financier was just obtaining 5%. And the distinction, that 400 basis points each year over two decades, was driven by the timing of the investment decisions. Manage your portfolio Safeguard your properties estate planning Retirement intending Handle your extremely Tax obligation financial investment and monitoring You will be required to take a risk tolerance questionnaire to provide your expert a clearer picture to establish your financial investment property allocation and preference.

Your advisor will analyze whether you are a high, medium or low risk taker and set up an asset appropriation that fits your threat resistance and ability based on the details you have supplied. A risky (high return) individual may invest in shares and home whereas a low-risk (low return) person may desire to invest in cash and term down payments.

See This Report on Guided Wealth Management

The extra you conserve, you can choose to invest and construct your riches. Once you involve a financial consultant, you do not have to manage your profile (financial advice brisbane). This saves you a great deal of time, initiative and energy. It is important to have appropriate insurance coverage plans which can provide peace of mind for you and your family.

Having a monetary expert can be extremely helpful for many individuals, but it is important to consider the pros and disadvantages prior to making a decision. In this post, we will certainly discover the benefits and disadvantages of functioning with a financial advisor to assist you make a decision if it's the appropriate move for you.

Report this page